FREE

1031 EXCHANGE (DST) GUIDE

Real estate investors can use a 1031 exchange to defer capital gains taxes, transition to passive property management, and potentially generate predictable income. Download our free guide to learn more about this tax-advantaged strategy.

.webp?width=300&height=391&name=Free%20Guide%20%26%20Calculator%20(4).webp)

You May Be A Candidate For A 1031 DST Exchange If You Are:

- Selling a Business

- Retiring from “Active Management” in Real Estate

- The Owner of Farmland

- Looking to Upgrade or Diversify Your Real Estate Holdings

- An Operator with Small “Left Over” Piece of an Exchange

Download our free guide to see the potential value of a 1031 (DST) exchange, what qualifies as a replacement property and what does not, and how a 1031 exchange works.

You will see an example of a 1031 (DST) exchange and a list of potential benefits.

Get Your Free Copy Now.

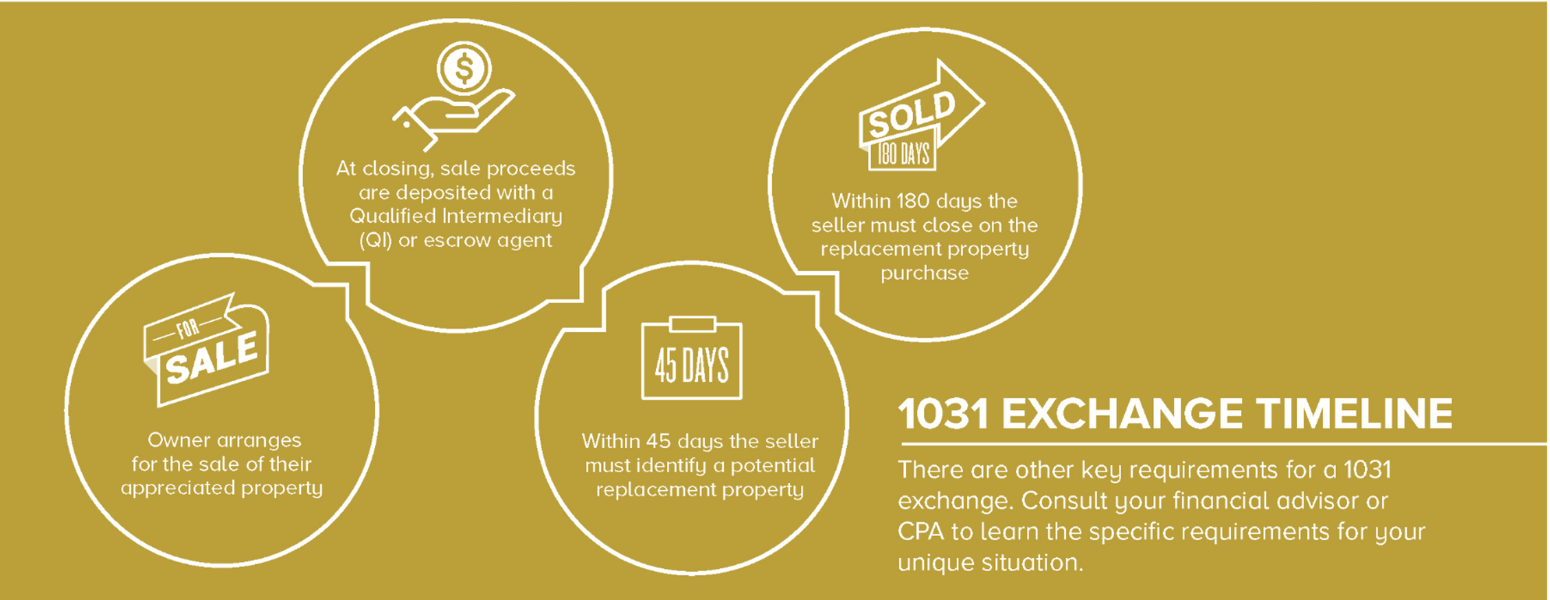

HOW A 1031 EXCHANGE WORKS

Section 1031 became part of the IRS tax code in 1921 and allows a taxpayer to sell an appreciated property and purchase another of equal or greater value without incurring an immediate tax consequence on capital gains. The replacement property must also have equal or greater debt and all proceeds from the sale must be invested in the replacement property to make the transaction completely tax deferred. In 1995, the IRS rules included a provision that allows for the purchase/exchange into a partial interest

of professionally managed real estate which today is usually accomplished through a Delaware Statutory Trust (DST).

WHAT IS A DELAWARE STATUTORY TRUST (DST) EXCHANGE?

The main difference between a 1031 Exchange and a DST Exchange is that in a 1031 Exchange, the investor actively manages the property. In a DST Exchange, the investor is passive – investing the proceeds from the sale of their appreciated asset into a fund where properties are professionally managed by the fund.

FOR EDUCATIONAL USE ONLY

Not an offer to buy, nor a solicitation to sell securities. Information herein is provided for information purposes only, and should not be relied upon to make an investment decision. All investing involves risk of loss of some or all principal invested. Past performance is not indicative of future results. Speak to your finance and/or tax professional prior to investing.

Securities offered through Emerson Equity LLC Member: FINRA/SIPC. Only available in states where Emerson Equity LLC is registered. Emerson Equity LLC is not affiliated with any other entities identified in this communication.

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments.

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits

This material is for informational purposes only, and does not constitute, or form part of a solicitation in any state or other jurisdiction or offer to purchase or issue limited partnership interests or any security or investment product. Any such offer or solicitation will only be made pursuant to the respective Fund’s Offering Documents and relevant subscription documents, which will be furnished to qualified investors on a confidential basis at their request. The information contained herein has been prepared by Keystone 1031, LLC and is current as of the date hereof.

Past performance is no guarantee of future results. An investment in the funds could suffer loss.

NEW YORK | ATLANTA | LOS ANGELES

MAILING ADDRESS: 350 JERICHO TURNPIKE, SUITE 302 | JERICHO, NY 11753 | 212-575-2152 | INVEST@KNPRE.COM | KNPRE.COM

Keystone National Properties, 2023